Latest News & Updates.

Stark Office Suites Increases Its Footprint in Stamford Westfair / Fairfield & Westchester County Business Journals |

|

Stark Office Suites expands its presence in Stamford by adding Stamford-Main Street to its extensive portfolio. This new location at 750 East Main Street presents business professionals with two prime Stark Office Suites properties in the heart of downtown Stamford. Combined with the existing Stamford-Tresser Boulevard location at 243 Tresser Boulevard, Stark Office Suites now offers 22,500 square feet in one of the region’s premier business hubs. Both locations provide free parking, along with easy access to the I-95 corridor and Stamford’s Metro-North and Amtrak rail station. “Staying local is the new normal and Stamford is a bustling city with a direct link to Manhattan,” said Adam J. Stark, president of Stark Office Suites. “Now, with two premiere properties, we offer a broader range of options for professionals and entrepreneurs in this great city.” At Stark Office Suites, worry-free offices are fully furnished and ready to move in. There’s no build-out necessary, so clients can immediately get to work in a professional Class A property that suits their every need, from a virtual presence to a corner office. “We feel fortunate to be able to welcome such a high-quality and proven operator to our building,” said Scott Raasch, Director of Business Development, Forstone Capital. “We are confident that Stark Office Suites will enjoy great success here and look forward to a productive, long-standing partnership with Adam and his team.” Offering value and selection, Stamford-Main Street features a gym, cafeteria, game room and an attractive lobby to help make favorable first impressions. Exposed ceilings and beams enhance the modern atmosphere and a shuttle to the train station provides exceptional convenience. “With flexible arrangements that can grow with any business, we offer an entire range of services, from turn-key technology packages to administrative support to high-end offices and private conference facilities,” said Stark. “We specialize in adapting to your business growth in real time – even during uncertain times.” The new location complements Stark Office Suites’ longstanding Stamford location, a stunning, glass-enclosed penthouse suite atop the Stamford Marriott Hotel & Spa. “Many companies are beginning to move forward and seeking to grow in an intelligent way,” said Stark. “There are massive challenges for everyone, of course, but the Westchester and Fairfield office markets are positioned for long-term growth and we will continue to look for opportunities to grow here.” With the addition of Stamford-Main Street to its portfolio, Stark Office Suites now includes a dozen top-tier business office locations in New York City, Westchester and Connecticut. Customizable plans are available to fit the needs of professionals, organizations and business entities, from virtual set-ups all the way to office suites complete with a full slate of support services. Plan options include access to every Stark Office Suites property, including One Grand Central Place – directly accessible from Grand Central Terminal – providing unparalleled convenience and elite addresses for client meetings. Eric Goldschmidt of Goldschmidt & Associates with offices in Mamaroneck, NY and Greenwich, CT represented Stark Office Suites for this transaction. |

LMHT Capital Acquires 97K-SF Charleston Office Property Connect Atlanta |

|

JLL has arranged the sale of the Offices at Nexton, a 97,448-square-foot office property in Charleston, S.C. The sales price was not disclosed. Built in 2014, the four-story office property is located at 201 Sigma Dr. in Summerville, approximately 24 miles from Charleston. Huston Green and Chris Lingerfelt of JLL represented the seller, Forstone Capital, LLC and Westport Capital Partners, in the transaction. In addition, Matt Casey and Van Glosson of JLL worked on behalf of the buyer, LMHT Capital, to secure acquisition financing through Credit Union Business Services. Photo: Connect Atlanta |

JLL arranges $42.9M financing for Nashville creative office JLL Newsroom |

|

JLL announced today that it has arranged a $42.9 million capitalization for 3040 Sidco Drive, a 157,000-square-foot creative office conversion project in Nashville, Tennessee. JLL arranged a joint venture equity partnership between Forstone Capital and an institutional private equity fund for the development, as well as a four-year, floating-rate acquisition and renovation loan through CIT Group. 3040 Sidco Drive is a former 132,000-square-foot industrial building that is being converted to 157,000-square-foot, Class A, creative office space featuring “best-in-class” amenities such as a fitness center with locker rooms, game room, tenant lounge, collaborative work spaces and ample parking. The single-story asset is located on 7.2 acres in the highly desirable I-65 corridor in Nashville between Brentwood and downtown. The JLL Capital Markets team representing the sponsor was led by Senior Director Jamie Leachman and Director Evan Parker. According to a recent JLL Research Report, creative office has taken storm in the periphery of urban Nashville. These creative office spaces, whether conversions or ground up developments, are attracting more than just their typical millennial tech jobs. Law firms, healthcare companies, and other traditional users are drawn to the open floor plans and interesting building characteristics of Nashville’s creative office product. “The marketing process yielded multiple competitive bids for both the equity and debt further demonstrating institutional appetite to invest in Nashville, one of the hottest real estate markets in the country,” said Leachman. “The partnership is poised to capitalize on this growth by reshaping the competitive landscape for creative office with the redevelopment of 3040 Sidco Drive.” The partnership has hired Bill Adair and Ashley Albright with JLL to handle the leasing. “The repositioning of 3040 Sidco as a creative office building speaks to the demand for this type of product we are seeing in the market. We are excited to work with Forstone Capital on the leasing efforts,” added Adair. JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm's in-depth local market and global investor knowledge delivers the best-in-class solutions for clients — whether investment advisory, debt placement, equity placement or a recapitalization. The firm has more than 3,700 Capital Markets specialists worldwide with offices in nearly 50 countries. |

One Hundred Oaks-area warehouse to see upgrade Nashville Post |

|

A One Hundred Oaks-area warehouse property that recently sold for $12 million is slated for a major overhaul courtesy of a $42.9 million loan. The address of the property is 3040 Sidco Drive. An entity affiliated with Stamford, Connecticut-based commercial real estate company Forstone Capital owns the property. Forstone also owns the Oaks Business Center at 2967-2977 Sidco Drive. JLL announced Monday in a release that it arranged the $42.9 million capitalization related to the 7.2-acre property. The 132,000-square-foot building will be overhauled to accommodate office space for creative businesses. It eventually will offer 157,000-square feet. JLL arranged a joint venture equity partnership between Forstone and an institutional private equity fund for the development, as well as a four-year, floating-rate acquisition and renovation loan through CIT Group. The JLL capital markets team representing the sponsor was led by Senior Director Jamie Leachman and Director Evan Parker, according to the release. “The marketing process yielded multiple competitive bids for both the equity and debt, further demonstrating institutional appetite to invest in Nashville, one of the hottest real estate markets in the country,” Leachman said. “The partnership is poised to capitalize on this growth by reshaping the competitive landscape for creative office with the redevelopment of 3040 Sidco Drive.” The partnership has hired Bill Adair and Ashley Albright with JLL to handle marketing and leasing. |

Duo lands $43M for office building transformation Bizjournals.com |

|

Investors from Austin and Connecticut are morphing an industrial building into a hefty dose of trendy "creative office" space. Those investors, backed by a loan from CIT Group (NYSE: CIT), are turning 3040 Sidco Drive into a 157,000-square-foot office building with an array of amenities, including a fitness area with locker rooms, a lounge and a game room. The building is located south of downtown, off the Armory Drive exit of Interstate 65, near 100 Oaks Mall. Real estate company Jones Lang LaSalle Inc. (NYSE: JLL) announced $42.9 million of financing for the project in a Nov. 4 news release on behalf of its client, Forstone Capital, of Stamford, Connecticut. The funding includes a four-year "acquisition and renovation" loan from CIT Group. Forstone, via the entity 3040 Sidco Drive LP, had paid $12 million cash for the 7.2-acre property last month. That entity is registered to the Austin headquarters of private-equity firm Pennybacker Capital LLC, according to Texas. Similar industrial-to-office conversions are occurring more frequently in Nashville, a trend driven partly by soaring costs of new construction and the wider range of tenants finding themselves attracted to such settings. Two examples are the revitalization of the former Madison Mill property on Charlotte Avenue, and the renovation Creed Investment Co. did to a nearby Sidco Drive property. In 2017, Forstone paid $13.3 million for the nearby Oaks Business Center on Sidco Drive, which contains more than 60,000 square feet of office space. Bill Adair and Ashley Albright, brokers with JLL, will market the 3040 Sidco property and represent the Forstone/Pennybacker partnership in lease negotiations. No timeline was given for the upcoming construction. |

Downtown Stamford office building sells for eight figures Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

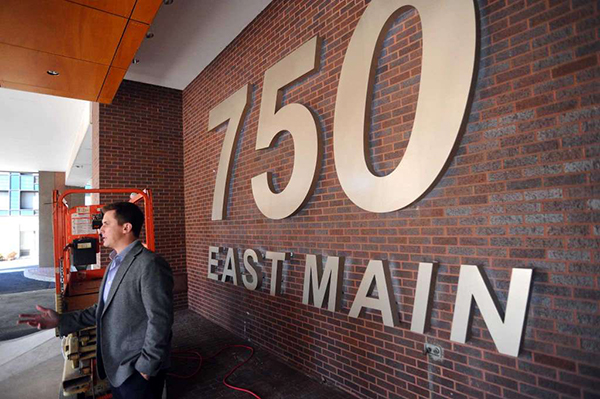

STAMFORD — A downtown office building has sold for approximately $18.2 million, in one of the city’s largest sales of the past year. “Forstone and the (real estate) brokers from Rhys did a spectacular job repositioning 600 Summer St.,” said New England Investment Partners co-founder and Principal Ari Yasgur. “This is an impressive and well-located building, with a strong and prestigious tenant base. We are proud and excited about this new acquisition.” Tenants include ground-floor offices of H&R Block and Stamford Bank & Trust, with several law firms and other corporate offices on the upper floors. “Our business plan was based around adding value through comprehensive building improvements and providing high-quality build-outs at competitive rents,” said Scott Raasch, Forstone’s director of business development. “We feel we accomplished this goal, and the time was right to sell the asset.”Six Hundred Summer’s sale produced about $227,000 in state conveyance taxes. The seven-story structure, which was built in 1970, was appraised for about $15.5 million in 2017, according to the Vision Appraisal property database. Forstone made about $1.4 million worth of renovations to the property. They included new elevator lobbies and bathrooms on each floor, new signage, a new glass awning and entranceway and improvements to the main lobby, parking lot and mechanical equipment. In Stamford, Forstone also owns office blocks at 750 E. Main St., and 9 W. Broad St. Forstone bought the former property for approximately $8.1 million in 2016 and the latter, in a joint venture with Westport Capital Partners, for $14.5 million in 2013. It has since undertaken major renovations at the two buildings, which were both nearly empty when Forstone acquired them. Today, leasing levels run at about 90 percent at 9 W. Broad and around 80 percent at 750 E. Main. Among other downtown building sales in recent months, the site of the Stamford Marriott hotel sold for about $32 million and a two-building complex at 1111-1117 Summer St., went for $12.4 million. The approximately $130 million sale last November of a Greenwich office campus at 100 W. Putnam Ave., marked the area’s largest property transfer of 2018. photo : Paul Schott |

PDC Brands plans HQ move to downtown Stamford Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

Beauty and wellness company PDC Brands is relocating its headquarters within Stamford, signing a lease for 26,500 square feet in the office block at 750 E. Main St., on the edge of the downtown. Now based in the High Ridge Park office complex off Merritt Parkway’s Exit 35, PDC is scheduled to move into its new space in the second quarter of 2019. It will be the largest tenant in the approximately 100,000-square-foot building, which is now 76 percent leased. “PDC is an innovative company with a global presence and a great reputation in its industry,” said Scott Raasch, director of business development at Forstone Capital, the Darien-based real estate investment firm that owns 750 E. Main. “Their strength and vision for future growth make them an ideal anchor tenant.” Messages left for PDC were not returned. Commercial real estate firm Newmark Knight Frank represented PDC in leasing negotiations. “The modern space in the building and proximity to downtown Stamford make this an ideal choice for PDC,” NKF Senior Managing Director Tim Rorick said in a statement. When Forstone acquired the building for $8.1 million in November 2016, it stood idle, except for one tenant taking about 5,000 square feet. A number of departures in recent years had emptied the reddish-hued building, which stands yards from a Sheraton hotel and the sprawling office complex at 695 E. Main St.-200 Elm St. Last year, Forstone undertook approximately $.15 million of renovations on the 10-floor building, which dates to 1986. The work includes a redesigned main entrance, with a new driveway and plaza; a refurbished main lobby; a new full-service cafeteria; a remodeled fitness center; and new board and game rooms. Today, the building is leased to nine tenants, which take an average of about 9,000 square feet. Among the tenants, Office Evolution, a national co-working firm, opened in May an approximately 10,000-square-foot center on the building’s sixth floor. It includes 34 private and furnished offices and several conference rooms. Forstone officials have said they aim to reach an 85 percent leasing rate at 750 E. Main by the end of 2019. “Given the high level of activity we’re experiencing, we’re optimistic we’ll achieve or outperform that goal,” Raasch said. “The remaining vacancy gives us flexibility to accommodate a variety of size requirements.” That usage level would rival the occupancy at 9 W. Broad St., which Forstone and Westport Capital Partners bought in 2013 for $14.5 million. The two firms invested more than $20 million in renovations to revive a property that, like 750 East Main, stood almost entirely vacant when it was bought. Forstone also owns an office building at 600 Summer St., which it acquired in 2015 for $10.65 million. |

CBRE announces the sale of 1365 Post Road East, Westport CT CityBizList / Commercial Real Estate Connect |

|

Jeffrey Dunne, David Gavin and Travis Langer of CBRE's National Retail Partners represented the owner, CapFor Westport, LLC, in the sale of 1365 Post Road East (Route 1) in Westport, Connecticut. The team was also responsible for procuring the purchaser. 1365 Post Road East is a 50,795± SF grocery anchored center prominently situated on Route 1 (22,100 cars per day), the main retail corridor in prestigious Westport, Connecticut. The property is 95% leased and is anchored by Balducci's, a gourmet grocer, and Ulta, who is currently building out their space and expected to open in March. Additional tenants at the property include Tusk Home, W Hair & Color, Zaniac and Awareness Technologies, collectively providing an average remaining lease term over nine years. The Property's diverse and complementary tenant mix caters to the affluence of the Westport market, which boasts average household incomes over $245,000 and average housing values over $1 million. Mr. Dunne commented: "1365 Post Road provided a rare opportunity to purchase a grocery anchored center in the highly site constrained and prestigious Westport market. We expect the purchaser will fare well with the acquisition due to its strong rent roll, easily accessible Route 1 location and surrounding demographics that support high sales volumes." |

Six Financial set for move to downtown Stamford Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

STAMFORD — Six Financial Information USA, a data provider for the asset-management industry, is relocating its offices in the city from Springdale to the downtown, Hearst Connecticut Media has learned. The firm will take approximately 13,300 square feet in the office building at 9 W. Broad St. Its local offices are currently based in the 3 building, on One Omega Drive, in the River Bend Center office park. Six Financial also maintains offices in Manhattan, Boston and San Francisco. Officials of Six Financial were not immediately available for comment. The arrival marks the latest phase in an ongoing revival of the approximately 200,000-square-foot 9 W. Broad St. building, which languished nearly empty before its acquisition four years ago by its current owners, Darien-based Forstone Capital and Wilton-based Westport Capital Partners. Renovations worth more than $20 million and active recruiting by real-estate firm Rhys have since propelled the property to an occupancy rate of more than 80 percent. Among other recent arrivals, real estate investment firm Waypoint Residential moved in July to renovated offices covering 11,500 square feet on the eighth floor. “The location is really ideal with the park right next to us and with easy access to downtown,” Waypoint Chief Operating Officer Peter DiCorpo said in an interview earlier this year. “The team at Forstone have really done an amazing job with this building. It is a true turnaround story and a great value-added execution. It felt like home.” Using 9 W. Broad as a model, Forstone is finishing up renovations of an 100,000-square-foot office building it owns at the other end of the downtown, at 750 E. Main St. Like 9 West Broad, 750 East Main also stood mostly vacant when it was purchased by Forstone last year for about $8 million. A year later, signed tenants combine for about 35,000 square feet. “What we’ve had success with in Stamford is buying it at the right basis, which allows you to improve the building, reposition it and create a first-class building, fully amenitized, but still offer value rents,” said Forstone Principal Brandon Hall. |

Rollease Acmeda, Office Evolution move into 750 E. Main in Stamford Westfair / Fairfield & Westchester County Business Journals |

|

Approximately 35,000 square feet of new leases have been signed to a variety of tenants at the newly upgraded office building at 750 E. Main St. in Stamford, according to owner Forstone Capital LLC. Most of the activity has been centered on two tenants, Rollease Acmeda Inc. and Office Evolution, both of whom are expected to move in early next year. Represented by Budd Wiesenberg and Bob Caruso of CBRE, Rollease Acmeda’s new corporate office and showroom will be on the seventh floor, totaling approximately 18,000 square feet. Formerly at 200 Harvard Ave. in Stamford, the company designs and manufactures window covering hardware, automated shades and machinery for use in both commercial and residential applications. Office Evolution, a national franchise offering co-working spaces, conference rooms, virtual office services and fully furnished offices and suites, will be on the sixth floor of the building, occupying approximately 10,000 square feet. It was represented by Craig Ruoff of Cushman & Wakefield of Connecticut. Designed by Beinfield Architecture, the building’s renovations include a new main entrance and vehicle access/circulation, a fully redesigned main lobby, and a modernized amenity package such as a cafeteria, updated fitness center and locker rooms, and new private board and game rooms. Across the street from the BLT Financial Centre at 200 Elm St., the building also offers tenants access to a dedicated shuttle to and from the city’s transportation center and to more than 300 covered parking spaces. Additionally, on-site security personnel and property management is provided. |

Renovated downtown Stamford office building aims for comeback Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

STAMFORD — In the four past years, Forstone Capital has filled its once-vacant office building at 9 W. Broad St. Now, it wants to accomplish the same feat with an office complex on the other side of the downtown. After buying 750 E. Main St. in November 2016 for $8.1 million, the Darien-based real estate investment firm has implemented the strategy that spurred the revival of 9 West Broad: extensive renovations and robust marketing. The plan has quickly reaped dividends at 750 East Main, as new tenants have combined to lease about one-third of the approximately 100,000-square-foot structure. “There is a good excitement and energy in the building,” Forstone principal Brandon Hall said in an interview this week at 750 E. Main. “It’s all new and upgraded space, which gives the building a great feel.” When Forstone bought the property, it languished with total vacancy, aside from one tenant taking about 5,000 square feet. A series of departures in recent years had emptied the building, which sports a reddish exterior and stands yards from a Sheraton hotel and the sprawling BLT Financial Centre office hub. Top-to-bottom renovations, worth about $1.5 million, are nearly complete on the 10-floor building, which dates to 1986. The months of work encompass a redesigned main entrance, with a new driveway and plaza; a refurbished main lobby; a new full-service cafeteria; a remodeled fitness center; and new board and game rooms. “We took the approach of making the entrance of the building more conductive to how people would arrive,” said Mark Goodwin, a principal of Norwalk-based Beinfield Architecture, which oversaw the renovations. “Inside, we wanted to improve the spaces in the building that felt kind of cold. With areas like the cafe and fitness center, we added warmth with features such as simulated wood flooring.” So far, Forstone has signed approximately 35,000 square feet of leases. The new tenants are taking offices from 2,500 square feet to 18,000 square feet. Rollease Acmeda — which designs and manufactures window-covering hardware, automated shades and machinery — is set to become the building’s largest tenant in the first quarter of 2018. It has signed a lease to take some 18,000 square feet for corporate offices and a showroom, which would cover the entire seventh floor. Office Evolution, a national office-services firm, will take about 10,000 square feet on the sixth floor. It is also scheduled to arrive within the next few months. Forstone aims to reach an 85 percent leasing rate by the end of 2019. That level would roughly equal the occupancy at 9 W. Broad St., which Forstone and Westport Capital Partners bought in 2013 for $14.5 million. The two firms invested more than $20 million in renovations to revive a property that, like 750 East Main, stood almost entirely vacant when it was bought. Forstone also owns an office building at 600 Summer St., which it acquired in 2015 for $10.65 million. “What we’ve had success with in Stamford is buying it at the right basis, which allows you to improve the building, reposition it and create a first-class building, fully amenitized, but still offer value rents,” Hall said. The city’s persistently high office vacancy rate — hovering around 30 percent — does not necessarily intensify competition among 750 East Main and other office properties with large blocks of available space, Forstone officials said. They are generally recruiting tenants with much smaller footprints than their neighbor, the BLT Financial Centre, which has two occupants, Deloitte and Henkel, each taking more than 100,000 square feet. “Between 3,000 and 10,000 square feet, there’s a lot of activity in Stamford right now,” said Scott Raasch, Forstone business development director. |

Downtown Bridgeport Apartments Unveiled Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

Almost 10 years after the property changed hands, apartments in a State Street building overlooking McLevy Green in the heart of downtown Bridgeport are almost ready for occupancy. The McLevy Square development by Darien-based Forstone Capital will bring new residents to the neighborhood and, just as importantly, give them something to do, with a comedy club and beer hall looking to begin operations in the coming months. “I find it exciting as a downtown resident,” Mayor Joe Ganim said at a ribbon-cutting ceremony Wednesday. “It’s another step, but an important one, in the fabric of the city, but more importantly the downtown.” The $18 million project features 32 one- and two-bedroom units, each one distinct in layout or other details. Many overlook McLevy Green, with oversize windows allowing for plenty of natural light. Each unit includes a washer and dryer, air conditioning and dishwasher along with granite countertops. Twenty-five of the 32 units qualify as affordable housing with restricted income guidelines. Rents in all units will range from $1,200 to $1,600 per month. The development included public financing from the state Department of Housing as well as the Department of Economic and Community Development and historic tax credits. Private financing came from M&T Bank. Nick Lundgren, deputy commissioner of the Department of Housing, said the agency has made great strides in adding affordable units around the state, citing $1 billion in public money going toward 21,000 homes. He cited the potential for “transformative impact” in a place like Bridgeport. “We need to create vibrant, inclusive communities where people want to live, work and invest,” he said. The Stress Factory Comedy Club at 167 State St., in the former Playhouse on the Green space, joins another location in New Jersey, which has attracted well-known comedians over the past 20 years. Harlan Haus, a German-style beer hall in the former People’s Bank building at 155 State St., will incorporate many of the historic bank attributes into the restaurant. Its owner also runs Harlan Social in Stamford and Harlan Publick in Norwalk. The development includes three other retail spaces, one of which will become Forstone’s property management office. The Backstroke, which formerly occupied one of the spaces before moving around the corner during construction, could return. Forstone also redeveloped the former Mechanics and Farmers Bank building on McLevy Green, occupied until earlier this year by the architectural firm Fletcher Thompson. Forstone said other parties have expressed interest in the location as office space. Brett Wilderman, principal of Forstone along with Brandon Hall, said it took some time to figure out the best use for the McLevy Square buildings. “We weren’t sure at the time exactly what they were going to be,” he said. “You can see their historic nature, but we needed to re-envision their future uses as something that the downtown wanted, and that would prosper. We think we found some exciting uses.” |

Connecticut real estate cash splashes down in Nashville Nashville Business Journal / bizjournals.com |

|

Real estate investors from Connecticut are expanding outside state lines for the first time, making an initial investment in Nashville that they hope will tee up a regional office for their firm. Forstone Capital LLC paid $13.3 million for the Oaks Business Center, which offers more than 60,000 square feet of office space in the 100 Oaks/Berry Hill area, immediately south of downtown. This is the 10-year-old firm's first investment outside of its home state, and co-founder Brett Wilderman said there's more to come — establishing Forstone as the latest in a slew of newcomer, out-of-state ( or even overseas) real estate investors swarming Nashville during its boom. Often, those investors have been willing to pay a premium to break into the market, increasing competition for property and enabling property owners to command higher prices for their holdings. "We are absolutely interested and plan on future investments in the Nashville metro area," Wilderman wrote in an email. "Our goal is to continue to invest in the market and eventually establish a regional office in Nashville. Historically, we've invested in Connecticut, but we're looking to diversify outside the market in mid-size cities with attractive growth fundamentals. Nashville hit on all marks." Forstone bought the two-building office property from Nashville-based Priam Ventures. Forstone paid Priam $1.8 million more than what Priam paid for the property two years ago. The sale of the Oaks Business Center underscores the shift Priam Ventures is making as the kind of deals they seek locally are vanishing. The 7-year-old investment firm once had holdings in Germantown, Sylvan Park and elsewhere in Nashville. After shedding the Oaks Business Center, Priam owns just one local building, at 9005 Overlook Blvd. in Brentwood. It's now on the market, listed with brokerage firm CBRE Group Inc., which Priam also retained to market the Oaks Business Center. "We have capital to deploy. Right now, we're focused on other markets with attractive deals," said Brian Adams, a principal in Priam Ventures. As examples, Adams cited a Memphis property purchase earlier this year, and he said he's a couple of weeks from closing a deal in Indianapolis. |

Beauty retailer takes Anthropologie space in Westport Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

Ulta, Westport CT Ulta Beauty is leasing the former Anthropologie store at 1365 Post Rd. East in Westport, following the latter retailer’s opening its new Anthropologie & Co. store earlier this year at the Bedford Square development in downtown Westport. Ulta Beauty sells a wide range of cosmetics and salon brands. The Westport opening will be Ulta’s fourth in southwestern Connecticut after locations in Danbury, Norwalk and Milford. The company is on track to open 100 new stores this year. “New store productivity continues to be very strong, reflecting excellent site selection, growing brand awareness and an increasingly appealing assortment of brand,” said Ulta Beauty CEO Mary Dillon, in a late-May conference call with investment analysts. “(The) notion of ‘all things beauty all in one place’ clearly is resonating.” The Anthropologie building is owned by Darien-based Forstone Capital which was represented by Newmark Knight Frank in the transaction, and True Commercial Real Estate representing Ulta Beauty. |

New apartments, entertainment options coming soon to downtown Bridgeport Hearst Media / Stamford Advocate, Greenwich Time, Danbury News Times |

|

McLevy Square, Bridgeport CT The windows may be boarded up now, but once the new glass panes are installed on the front-facing apartments in the buildings now under renovation on State Street, residents will have among the best views downtown. Overlooking McLevy Green, the structure at 177 State St. will provide skybox-style seats to the annual Downtown Thursdays concerts in the summer and stunning views of the holiday lights and snow-covered green in the winter. “We’re on the doorstep to getting the project complete,” said Brett Wilderman, principal at Darien-based Forstone Capital, which later this year will finish the roughly $18 million renovation of the structures at 155-189 State St. and 899 Main St. “We’re very close.” Forstone will begin accepting applications for the 32 apartments — a mix of studios, one- and two-bedroom units — next month. Wilderman said he hopes tenants can begin occupying the units, 25 of which are affordable apartments with restricted income guidelines, in late August. Rents will range from $1,200 for the smaller one-bedroom units to $1,600 for the larger two-bedroom units. The following month, the German beer hall, Harlan Haus, will open in the former People’s Bank building, which also housed Roberto’s Restaurant for nearly two decades. Harlan Haus, which has already established a presence on Facebook, is the brainchild of Stephen Lewandowski, owner of Harlan Social in Stamford and Harlan Publick in Norwalk. In October, the Stress Factory Comedy Club is expected to open, as well, in the former home of the Playhouse on the Green. The club will be owned by Vinny Brand, who also has a location in New Brunswick, N.J. Another ground-floor commercial space, at 189 State St., will be occupied by Forstone’s own management office, which will move from its current location on Fairfield Avenue. Tenants are not confirmed for the two remaining spaces, at 899 Main St. and the former location of The Backstroke on the ground floor space of the apartment building. The chiropractic and wellness business remains at its current location at 37 Markle Court, where it relocated before the renovations began. It’s not clear whether it will remain at that location. Wilderman noted Forstone is speaking to a potential tenant for the Main Street site, which has stained glass windows on the ceiling. “We have a couple of potential uses there; one is a distillery that would produce and sell their product there,” Wilderman said. Final decisions about those spaces will be made in the coming months, he added. For years, progress on downtown’s revitalization has centered on Phil Kuchma’s Bijou Square development on Fairfield Avenue, the rehab of the Citytrust and Arcade building on lower Main Street and development on the Downtown North properties along the outer edge of the downtown. “Forstone is a top-notch developer,” said Thomas Gill, economic development director for the city. “They do quality work. Anything they touch they do first-rate.” The State Street properties are not the first project along the green that Forstone has taken on, nor will they be the last. Several years ago the company completed a renovation of the former Mechanics & Farmers Bank and the adjacent building, converting the structure on the corner into 30 apartments known as the Landmark apartments, and renting out the bank space to the Fletcher Thompson architectural firm. That commercial space has been empty for several weeks, since Fletcher Thompson was evicted due to nonpayment of rent. “The layout is a little unique so we need to find the right use,” Wilderman said of the space. “We’ve been in discussion with a few interested parties that we think will be a great addition to the downtown.” Forstone also owns the former Board of Education building, one block over from the Mechanics & Farmers Bank building on Main Street. Wilderman said plans for that building are still being formulated. “We’ll see where the demand is,” he said. The building is now empty, as is McLevy Hall, the historic building directly adjacent to the green. That building, however, is city-owned. Gill said he expects interest in McLevy Hall to increase with the completion of Forstone’s State Street projects. “Obviously that building is special and needs to be preserved,” he said. Bill Coleman, Bridgeport’s deputy director of planning and economic development, said McLevy Green is a “tremendous asset” in the downtown. The space is now the site of the seasonal farmer’s market, and the Downtown Thursdays concert series held there over the last several years have proven to be a popular draw. Some festivals and parades, including the annual Juneteenth celebration, have also used the space over the years. “The focus on the green is starting to attract more investment downtown,” Coleman said. Gill said the introduction of the beer hall and comedy club will only serve to enhance people’s perceptions of the downtown and the offerings to visitors of the nearby arena and ballpark. “The options are increasing to come and stay,” he said. With all of their projects, Wilderman said Forstone has two goals. “Our objective with that (area) is to find uses that the local Bridgeport residents want and find useful and exciting, but who new customers to the Bridgeport area will be interested in (too),” he said. |

Property Rounds: Some office buildings make comebacks in tough times Hearst Media / Stamford Advocate, Greenwich Time |

|

9 West Broad Street, Stamford CT In early 2013, 9 W. Broad St. on the edge of downtown Stamford languished as an empty and neglected property. Today, it hums with activity as some 400 workers stream in and out of a refurbished nine-story structure. Stamford and other communities in southwestern Connecticut still grapple with office vacancy rates hovering above 20 percent. But the revitalization of 9 W. Broad St. and the turnaround of similar buildings show how property owners’ capital investments and the draw of central locations can make corporate hubs attractive to tenants in a challenging market. “There is a little reticence in the market to being that first tenant in, so the owner has to prove themselves,” said John Hannigan, principal of Choyce Peterson in Norwalk, a firm that represents tenants in commercial real estate transactions. “And they do that by … tenants having the comfort of seeing that renovations are going on or recently completed.” Selling a vision Forstone Capital and Westport Capital bought 9 W. Broad St. for $14.5 million in March 2013. Built in the early 1980s for the Nine West shoe company, the occupancy rate in the approximately 202,000-square-foot building declined as major tenants, including Nine West, relocated. A lack of upgrades hindered the recruitment of newcomers. The new owners quickly brought in commercial real estate firm Rhys as their broker to lease and market the building. Sensing the property’s potential, Rhys then moved its own offices to the building. “You really have to paint pictures at first on paper,” said Christian Bangert, executive vice president and principal of Rhys. “We were bringing in tenants and saying this is what it’s going to look like. Then the leases started coming quicker (after renovations started) just because tenants weren’t as concerned whether this would happen.” To make the building competitive again, Forstone Capital and Westport Capital have invested more than $20 million in exterior and interior improvements, including office buildouts, according to Bangert. The improvements have encompassed roofing, elevator and mechanical systems, the creation of a front plaza and cul-de-sac and “skinning” work that gave the building exterior its distinctive tan-brown hue. In addition, the owners installed amenities including a cafeteria, gym, conference center and private boardroom. The building’s overhaul has spurred a cascade of leasing deals. To date, Rhys has brokered 25 leases at 9 West Broad, which stands across the street from Mill River Park. Tenants now take up about 80 percent of the building, with the list of occupants including technology, health, energy, real estate and finance firms. Improved outlook In Norwalk, the i.Park Norwalk complex at 761 Main Ave., on the Wilton line, stands out as another revived property. In redeveloping the historic Perkin Elmer headquarters, Greenwich-based National Resources drew L.A. Fitness into a new auxiliary building at i.Park Norwalk to provide a major amenity for tenants, while populating the main headquarters building with a number of health clinics affiliated with Norwalk Hospital. And in 2013, the developer claimed the figurative yellow jersey after the Cannondale Sports subsidiary of Dorel Industries chose i.Park Norwalk for its own headquarters, relocating from Bethel to occupy both the main building and a smaller outbuilding in the rear. In Greenwich, Greenwich Office Park has also seen its outlook improve in recent years. Built in the 1970s as the headquarters for UPS and later a campus-style office option for a number of companies, it fell victim in recent years to its aged look and an “end-zone” location in western Greenwich. High vacancy rates plagued the office park, so the property’s managers Clarion Partners and CBRE Group opted to invest millions in renovating the buildings’ interiors and landscaping. The renovations culminated in a sale last fall to Greenwich-based Fareri Associates at about $344 per square foot. The deal ranked as the largest Greenwich office sale in five years, according to CBRE. In Milford, the former Smiles Amusement Center property on the Boston Post Road, near the Connecticut Post mall, sat vacant for roughly four years after the entertainment center closed in 2011. The old teen hangout was demolished in 2015 and last year was replaced with a brand-new plaza with tenants including REI Co-op, a Verizon store and Panera Bread. In Danbury, the Lee Farm Corporate Park has flourished since Southport-based Summit Development purchased the 215,000-square-foot building in 2013. Lee Farm was about 70 percent leased when Summit purchased the building for about $17 million. The building has hit 100 percent tenancy, even after withstanding the departure of GE Capital, which was spun off by its corporate parent in 2015. Wells Fargo acquired some of GE Capital’s assets and promptly leased 71,000 square feet in Lee Farm. It recently completed building out its space at Lee Farm. Sustaining momentum Rhys executives said they plan to bring in a number of new tenants this year at 9 West Broad St. Another 7,000 square feet to 10,000 square feet could be leased in the next couple of months, according to Bangert. The asking annual rate for 9 West Broad’s tenants is $34 per square foot. For a firm with 5,000 square feet, the annual outlay would come to $170,000, not including electrical costs. “We’ve created something that didn’t exist here in the Stamford market, in the sense of its uniqueness and style,” Bangert said. “For the younger, modern tenant that’s coming into the marketplace, it’s definitely something of interest to them.” |

March of Dimes marshals real estate community Westfair Online |

|

Brett Wilderman, left, and Brandon Hall, event honorees and principals, Forstone Capital. The 20th annual March of DimesFairfield County Real Estate Award breakfast drew a packed-house crowd of 700 to the Hilton Stamford Hotel & Executive Meeting Center recently. Forstone partners and co-founders Brandon Hall and Brett Wilderman were the event honorees. Since Forstone’s founding in 2007 the New Canaan boyhood friends’ company has acquired more than 1.2 million square feet of real estate. Its services include property management, asset management, construction and leasing. The breakfast’s top sponsors were The Ashforth Co., which was the event’s inaugural honoree and which additionally provided this year’s marketing and management support; Building and Land Technology, the 2003 event honoree; and Forstone Capital. A Who’s Who of county companies filled out the gold, silver, bronze and “Fund the Mission” sponsorships, 60 in all. The event across the years has raised more than $6 million toward funding the March of Dimes mission to promote term pregnancies and to help preemies and their families. The 2015 breakfast alone brought in $56,000 via texting NICU to 41444. (NICU – an acronym for neonatal intensive care unit – is a common reference at March of Dimes events and is pronounced “nickew”.) The top donation by text won a three-course lunch and cooking demonstration for up to 15 persons with Chef Stephen Lewandowski at Harlan Publick in Norwalk. “The Real Estate Award Breakfast honors outstanding individuals or companies whose commercial real estate activities have significantly enhanced the local community,” March of Dimes said in a prepared statement. “We are proud to recognize Forstone for their area revitalization efforts and applaud their principals for their leadership and community advocacy,” said Ed Tonnessen, chairman of the Real Estate Awards committee and executive managing director at Jones Lang LaSalle. Stamford Mayor David Martin offered an upbeat appraisal of the host city’s health, noting citywide unemployment had fallen from 5.1 percent a year ago to 4.1 percent now. He cited $6 billion in construction now underway and an apartment occupancy rate of 96 percent. “The reason our rents are so high is because our occupancy rates are astronomical,” he said. Martin ticked off a number of scientific breakthroughs – the theory of relativity, the development of penicillin and the polio vaccine – and said March of Dimes progress is fueled by science. “I take it as a great disappointment that ignorance of science is seen by some as a way to be more popular today,” he said. Martin said science was not about faith, but investing in science nonetheless demonstrated a worthy faith in the scientific process. “How quaint, my parents and grandparents put those dimes into those cardboard boxes on store counters,” he said. “Their faith in science obliterated polio. It changed the world.” |

March of Dimes honors Forstone Capital Fairfield & Westchester County Business Journals |

|

March of Dimes will honor Forstone Capital with its 2015 Real Estate Award at its 20th annual March of Dimes Fairfield County Real Estate Award Breakfast, the organization said recently. Forstone partners and co-founders Brandon Hall and Brett Wilderman were slated to accept the award at The Hilton Stamford(One First Stamford Place) on Thursday, December 3, at 8 a.m. “The Real Estate Award Breakfast honors outstanding individuals or companies whose commercial real estate activities have significantly enhanced the local community,” March of Dimes said in a prepared statement. “Throughout the event’s almost two-decade-long history, nearly $6 million has been raised in support of the March of Dimes mission to give all babies a healthy start.” More than 700 industry professionals were expected to attend the event. Prior to starting Forstone Capital, Wilderman was director of acquisitions for HEI Hospitality, a real estate firm that specializes in acquiring and managing hotels throughout the U.S. Currently, he is a board member of Stamford Downtown Special Services District. Before co-founding Forstone Capital, Hall was a senior associate for GE Commercial Finance Real Estate. He focused on developing equity partnerships with national and local operators and helped acquire a $2.5 billion portfolio during his time at GE. He is currently commissioner and vice chairman of the Bridgeport Downtown Special Services District and is a board member of the Cornell Baker Program in Real Estate. “We are proud to recognize Forstone for their area revitalization efforts and applaud their principals for their leadership and community advocacy,” said Ed Tonnessen, chairman of the Real Estate Awards committee and executive managing director at Jones Lang LaSalle. “We are humbled to receive this award from an organization as noble and influential as March of Dimes,” said Wilderman. “We feel fortunate to be able to work among such first-class peers in Fairfield County’s real estate industry and know that together we can make a difference in the communities in which families – like our own – live and grow.” |

Darien-Based Developer Goes Green, Saves With C-PACE Program Darien Daily Voice |

|

Forstone Capital partners Brandon Hall and Brett Wilderman have found success using the Connecticut Green Bank C-PACE PACEsetter program. Photo Credit: Contributed After the coldest February on record for Bridgeport, everyone is discussing two major issues: global climate change and the cost of energy. Luckily, for commercial, industrial and multifamily property owners, the Connecticut Commercial Property Assessed Clean Energy’s (C-PACE) launch of Green Bank just two years ago has helped more than 90 property owners “go green,” and the benefits can be seen here in Bridgeport. Forstone Capital, a Darien-based real estate investment firm whose principal Brandon Hall was recently featured in a “Bridgeport Better Every Day” advertisement, has been taking advantage of C-PACE funds from the Connecticut Green Bank to renovate a 98,000-square-foot office space at 855 Main St. With this partnership, Forstone was able to garner about $2 million to finance HVAC upgrades, new cooling towers and energy-management measures that will bring in more than $6 million in savings over the life of the upgrades, according to the Connecticut Green Bank. Forstone’s success in Bridgeport is just one of many projects that Connecticut Green Bank CEO Bryan Garcia was happy to announce at the two-year mark of the organization's quick start and growth. “We are thrilled by the success of the C-PACE program,” said Garcia, “In just two years, we’ve seen the first securitization of C-PACE transactions in the country and allocated more than $65 million of capital, enabling property owners to make deep energy upgrades and control their energy costs.” The City of Bridgeport has also done its part in making sure information on C-PACE and “PACE” funding are readily available through their website for Bridgeport business owners. The push for a greener industrial, commercial and residential Connecticut comes as the industry has allowed from more financially sound upgrades, according to Garcia. "Clean energy is now more accessible and affordable to the commercial and industrial sector,” Garcia said. “We are supporting economic development and creating jobs, and the Connecticut Green Bank is leveraging limited public dollars to attract private investment.” |

New downtown Bridgeport entertainment in the offing Connecticut Post, Stamford Advocate, Danbury News Times, Greenwich Time |

|

Brandon Hall, left, and Brett Wilderman, principals at Forstone Capital, stand in the former Roberto's Restaurant in the old People's Bank building at the corner of Main and State Steets in downtown Bridgeport. They have plans for a number of new developments around McLevy Green, including the old bank which will be transformed into a German beer hall. Photo: Autumn Driscoll Once people move in, they need something to do. Downtown Bridgeport has seen a wave of conversions of unused buildings into apartments, introducing a downtown constituency to a neighborhood that a decade ago was mostly devoid of life. As more apartments come on the market, the next phase of growth is developing service and entertainment options for all those new residents. A few are in the offing. Forstone Capital, a Darien-based real estate investment firm with numerous holdings in downtown Bridgeport, has announced plans for a pair of new businesses aimed at both residents and visitors -- a German beer hall in the original People's Bank building at 155 State St., and a comedy club in the former Playhouse on the Green theater at 167 State St. "We're bringing in more residential, but also entertainment options," said Brett Wilderman, principal at Forstone. "We think those uses hit home on the character of downtown, and provide services for customers in the neighborhood but also serve as regional draws." The buildings are part of a collection of properties that Forstone and Norwalk's Spinnaker Development bought from People's United Bank, based downtown, in 2008. The 60,000-square-foot, four-building Forstone development fronting on McLevy Green is scheduled to be fully developed next year. The future beer hall was for years the home of Roberto's restaurant, which closed in 2010 after 17 years in business. Playhouse on the Green, which closed in 2011, is slated to be the home of The Stress Factory comedy club, which also has a location in New Brunswick, N.J. The building next to that will be converted into 32 apartments with ground-level retail. "The buildings have tremendous history and character, and we're trying to bring them back to life here with uses that are sustainable," Wilderman said. Most successful downtown redevelopments follow a familiar pattern, said John Simone, president and CEO of the Connecticut Main Street Center, a Hartford-based nonprofit agency that helps communities facilitate downtown development. "The classic downtown revitalization is when you first have the pioneers coming to live downtown, and as that critical mass builds, you're able to support retail, small businesses, coffee shops," he said. "It's incremental and it evolves." While it can be hard to attract people to live in a neighborhood with few services, it's much more difficult for businesses to sustain themselves without a dependable customer base. "There's no simple formula, and it's really an organic process," he said. National retailers have specific requirements about the number of local residents required before they will consider moving into a neighborhood, he said. "If you don't reach those numbers, they won't even bother," he said. "If you reach it, maybe they'll take a look." It's important to think local first, Simone said. "You want to look to local entrepreneurs," he said. "Look at businesses that are already there, and see if there are ways for them to expand their product lines to accommodate people moving in. It's a local phenomenon, and not every store has to appeal to every target market." A grocery store has long been considered a classic sign of a neighborhood's arrival. In 2013 a 7,500-square-foot market with separate grocery, deli, bakery and cafe sections opened in the Arcade on Main Street, but closed six months later. "A grocery store is a milestone if it stays," Simone said, and attracting a major grocery store is difficult. "You need to hit very specific numbers before they'll even talk to you," he said. "They operate on the thinnest of margins." He said Bridgeport's continued growth downtown is a sign of unmet regional demand for that style of living, and that businesses will follow the people. |

Investor interest in commercial property picking up Connecticut Post, Stamford Advocate, Danbury News Times, Greenwich Time |

|

Scott Raasch, director of business development for Forstone Capital, in the lobby of the former Mechanics & Farmers building on Main Street in downtown Bridgeport, Conn. on Wednesday, September 24, 2014. The company is currently developing several projects in the city. Photo: Brian A. Pounds As the economy slowly improves, more commercial real estate executives are looking to develop assets and deploy capital in secondary markets to generate returns, and the Greater Danbury market is providing opportunities. Of the 100 senior commercial real estate executives surveyed in a 2014 Commercial Real Estate Outlook Survey conducted by tax advisory firm KPMG, 68 percent expect to increase capital spending in 2014, up from 60 percent in 2013. Interest in the Danbury area is increasing, according to Felix Charney, president and CEO of Fairfield-based Summit Development, but available properties are at a premium. Charney faced stiff competition when he sought to purchase Lee Farm, the 215,000 square-foot office complex in Danbury last year. "There was an investment fund from White Plains, N.Y., that put it under contract, but they dropped out," said Charney, who has developed more than 3.75 million square feet of commercial space and more than 950 residential units. `Next ring' When Summit and its partner, The Grossman Cos., of Quincy, Mass., bought Lee Farm in April 2013 for $16.9 million, a third of the building was vacant. "We've leased 50,000 of the 71,000 square feet. We'll soon be at 95 percent occupancy," he said, adding that Danbury commercial properties are becoming attractive to prospective investors as available lower Fairfield County properties are snapped up. "Danbury is the next ring of the circle. Coastal Fairfield County is expensive, so people move to the north or east." Charney has learned to see potential in under-valued or distressed properties that require adaptive re-use of a building or brownfield site. "I'm in the business of manufacturing land. That's a term I use all of the time. I have to buy tainted assets," he said. "We're land-constricted (in Fairfield County) and have restrictive zoning. As a result, land prices are high, and it ultimately curtails supply." While the KPMG survey is revealing, because it is on a national scale it does not tell the whole story about commercial real estate investment at the regional level, according to Charney. "You can't apply macro-economics to real estate," he said, because commercial real estate is local. `Very limited supply' Like Charney, Joe Wrinn, a broker with Goodfellow Ashmore, a commercial real estate firm in Danbury, has followed the area market for nearly 25 years, said the commercial real estate market in northern Fairfield County is constricted. "There's only so much institutional-grade investment property to go around," he said. "I always have calls from people wanting to get into the investment arena. The demand for those income-producing properties is always high -- starting at $1 million. There's an awful lot of demand, but very limited supply." Most owners of prime commercial property in the Danbury area prefer to retain their holdings because they are income producers, Wrinn said. "Where else are they going to put their money," he asked.

855 Main Street in downtown Bridgeport, Conn. is one of several city buildings being developed by Forstone Capital. Photo: Brian A. Pounds

McLevy Square the block of buildings on State Street in downtown Bridgeport, Conn. across from McLevy Green, is scheduled for development by Forstone Capital. Photo: Brian A. Pounds The limited supply of available Class A office space in the county is causing investors to look a Class B office properties, said Mary Grande, a Stamford-based partner in KPMG's Metro New York Financial Services tax practice. "Leasing activity has improved in Fairfield County," she said, "and there is a shift toward foreign investment in the market." Much of the interest can be attributed to the region's proximity to New York City where premium office space in Manhattan is reaching capacity, she said. The KPMG study shows that 80 percent of executives expect foreign investment in U.S. real estate to increase. Roughly 40 percent of those respondents predict non-U.S. investment to climb by 6 to 10 percent, while 8 percent expect an increase of more than 20 percent. "We've seen a substantial amount of Chinese capital deployed in 2014, and we expect that trend to continue as real estate funds, large institutions and foreign investors look for direct and indirect investment in real estate equity and real estate debt because of the attractive yields," said Phil Marra, leader of KPMG's National Real Estate Funds. When asked to identify regions with the best real estate investment opportunities, almost half the respondents in the KPMG study chose the Southeast (48 percent, up from 28 percent in 2013). The Northeast ranked fourth, behind the Southwest and Midwest with 30 percent of participants saying it offered the best real estate investment opportunities -- down from 36 percent in 2013. When asked which types of properties their company would be looking to acquire or invest in, Class A assets in primary markets led the list, followed by development opportunities, distressed assets, Class A assets in secondary or tertiary markets and Class B/C assets. |

New Downtown Apartments Unveiled Connecticut Post, Stamford Advocate, Danbury News Times, Greenwich Time |

|

BRIDGEPORT -- Nearly shouting to be heard over the buses and the music festival across the street, city and state officials Thursday unveiled what they hope with be the cornerstone of the city's downtown renaissance -- 30 luxurious but affordable apartments and a voluminous office space. The project is aptly named Landmark because it has risen from the hulking landmark Mechanics & Farmers Bank building that has sat empty on Main Street opposite McLevy Green for a decade. And it is another jewel in the crown of Norwalk's Forstone Capital, which already owns -- by itself or with partners -- a dozen downtown buildings.

A view of the new apartments that are inside the former Mechanics & Farmers Bank building in downtown Bridgeport, Conn. on Thursday, Aug. 21, 2014. Photo: Christian Abraham

Christopher Petre, an estimator with Viking Construction, checks out one of the apartments available in the new renovation inside the former Mechanics & Farmers Bank building in downtown Bridgeport, Conn. on Thursday, Aug. 21, 2014. Photo: Christian Abraham "When Brett (Wilderman) and I first looked at this building in 2008 it was even difficult to walk into, it was in such bad shape," said Brandon Hall, principal partner in Forstone. But shortly thereafter, the city put the three-story, block-wide building on the market and Forstone snapped it up for about $500,000. A big boost came when Fletcher Thompson, an engineering design firm with 60 jobs that had left Bridgeport for Shelton in 2002, agreed to rent out the cavernous first floor of the building. Forstone Capital was then awarded $3.3 million for the renovation project from the state through the Competitive Housing Assistance for Multifamily Properties initiative administered by the state Department of Economic and Community Development. The federal Environmental Protection Agency paid for much of the cleanup after the building was declared a federal brownfield. "There are great bones in this city and sometimes it takes people from outside with fresh eyes to see it," said Mayor Bill Finch. While Fletcher Thompson's employees will still have to wait a month or more to move into their new digs, Hall said they already have security deposits for 24 of the 30 apartments with some residents expected to move in by the end of the month. "We are showing the demand is here for people to live in downtown Bridgeport," he said.

Bridgeport Mayor Bill Finch, center, talks about the new apartments available in the former Mechanics & Farmers Bank building in downtown Bridgeport, Conn. on Thursday, Aug. 21, 2014. Standing with Finch are Forstone Capital Managing Partners Brandon Hall, left, and Brett Wilderman. Photo: Christian Abraham The apartments, on the second and third floors of the building, are either one bedroom or large studios ranging from 700 to 1,000 square feet. Depending on the size, the rents range from $1,050 to $1,300 with the higher-end apartments including small washers and dryers and spectacular views of McLevy Green. Designed by Fletcher Thompson, the floors are a combination of carpeting and wood panels and the kitchen countertops are granite. Parking is catch-as-catch-can, either on the street where it's free after 5 p.m. or at several of the Forstone-owned lots nearby. All are at renters' additional expense. Hall said many of the people who have made commitments to take the apartments commute to jobs in Stamford and New York. "I love it, the more the better," said Massimo Tabacco, owner of nearby Amici Grill, as he stood at the back of the crowd for the ribbon cutting. "I've been here five years and I'm starting to see more people coming downtown. The more people living downtown the better." Forstone, which set its development sights on the city in the mid 2000s, buying up with Norwalk partner Spinnaker Real Estate 10 downtown properties formerly owned by People's United Bank, has come under some criticism in the past for allegedly muscling out small businesses. The former owners of Take Time Cafe on State Street accused Forstone of forcing them out after taking over the building by doubling the cafe's rent. The Playhouse of the Green also closed after Forstone raised its rent after buying the building. And then there was Forstone's effort to force the venerable Ralph N Rich's out after Forstone and Spinnaker purchased the restaurant's building from People's. A Superior Court judge blocked that effort for now. But fellow downtown developer Phil Kuchma contends Forstone is very good for the city. "I think it's great they are investing here," he said. "It helps validate that there are reasons to develop in this city and we should be encouraging investment in the city from outside money." |

Washington Trust Provides Forstone Capital $2.76 Million to Acquire Retail Property in Westport, CT The Wall Street Journal |

|

Washington Trust's (Nasdaq:WASH) Commercial Real Estate Group recently provided $2.76 million to Forstone Capital, LLC to finance the acquisition of a single-tenanted retail property in Westport, CT. The property, currently occupied by Men's Warehouse, consists of 6,843 square feet of retail space. Constructed in 1989, the building is situated on a .64-acre parcel with high-visibility frontage along the densely populated commercial and retail area of Westport. "Westport has one of the lowest retail and office vacancy rates in Fairfield County," said Joseph J. MarcAurele, Washington Trust Chairman and Chief Executive Officer. "Forstone Capital's acquisition of this property will benefit from the property's excellent location in this strong retail market." Forstone Capital, LLC is a boutique real estate investment firm headquartered in Darien, CT. Since its inception in 2007, Forstone Capital has acquired over 1,000,000 square-feet of office, retail and multi-family properties throughout Connecticut. Washington Trust's Commercial Real Estate Group provides commercial real estate mortgages for the construction, refinancing, or purchasing of investment real estate projects. Financing ranges in size from several hundred thousand dollars up to multi-million dollar projects. For more information, contact Timothy M. Pickering, Senior Vice President, Commercial Real Estate Group, at 401-348-1482 or 800-475-2265 ext. 1482. |

Darien firm adds Stamford building to portfolio Connecticut Post, Stamford Advocate, Danbury News Times, Greenwich Time |

|

A Fairfield County partnership has acquired a Stamford office building and plans to spend $7 million to upgrade the property. Darien-based Forstone Capital teamed with certain funds managed by Westport Capital Partners in Wilton to buy a 200,000-square-foot building at 9 W. Broad St. According to documents at the Stamford Town Clerk's office, the seller was LBUBS 2000-CF River Plaza, a unit of LNR Partners in Miami Beach, Fla. The purchase price was listed at $14.5 million. The new owner plans to reposition the property by overhauling the building's roof, lobby, common areas, elevator cabs, amenities, entry points and mechanical and heating, ventilation and air conditioning systems. "Our vision is to reintroduce this asset to the market as a true Class A office building once the renovations are complete," said Forstone Principal Brandon Hall, citing the location in the city's central business district. "It's in a continually improving area." Forstone has 14 properties in Bridgeport and one each in Darien, New Canaan and Westport. This is its first in Stamford. "Stamford is a very competitive market. We've had our eye on Stamford for a while," Hall said. The team has engaged an architect to produce concept drawings, said Forstone Principal Brett Wilderman. "We are anxious to get started on transforming the building into something that the city of Stamford will be proud of and one that our future tenants will enjoy," he said. The project coincides with the unveiling of the Mill River Collaboration, whose Phase I stage is set to open this spring. Along with an ice skating rink and fountain, other amenities will include a carousel, fishing piers, kayak launch and a wooden canopy covering the park's central walking path. Forstone and Westport Capital are making a significant capital investment in the building, strengthening the field of Class A downtown office space, said Laure Aubuchon, the city's director of economic development. "It's a testament to the power of the Mill River. It's a park in their own backyard," she said. The location of the building provides panoramic views of Mill River Park and Stamford's central business district, said Stephen Woodard of Westport Capital Partners. Tenants can enjoy the park and walk to downtown amenities and the train station. RHYS Commercial of Stamford will market and lease space in the nine-floor building, which has the American Institute of Foreign Study as its major tenant. AIFS, however, plans to relocate elsewhere in the area. "9 W. Broad St., will be one of the premier assets in the market when the renovations are completed," said Cory Gubner, president and chief executive officer of RHYS Commercial. "This is the most exciting thing to happen to the Stamford office market in a very long time." He touted the building's proximity to Mill River Park and its access to Interstate 95 and the Stamford Transportation Center. The per-square-foot rental rate will be in the high $20s. "We think it's extremely competitive pricing wise. It will be a Class A building in every stretch of the word," Gubner said. RHYS already has several interested prospects, said Christian Bangert, senior vice president and principal of RHYS Commercial. "Our goal is to be able to offer prospective tenants a Class A office environment at Class B economics," he said. |

Joint Venture Picks Up 200,301-SF REO Property in Stamford National Real Estate Investor |

|

A joint venture comprised of Forstone Capital LLC and certain funds managed by Westport Capital Partners LLC has purchased 9 West Broad Street, a 200,301-sq.-ft. office property located in Stamford, Conn. HFF marketed the REO property on behalf of the seller with Jose Cruz and Andrew Scandalios, both senior managing directors, Kevin O’Hearn and Jeffrey Julien, both managing directors, and Steve Simonelli, associate director, representing the seller. Situated on nearly three acres, the property provides access to Interstate 95, Route 1, Merritt Parkway, the Stamford Metro North commuter rail station and Stamford Town Center. Standing nine stories tall, 9 West Broad was renovated in 1999 and anchored by American Institute for Foreign Studies. Amenities at the property include a cafeteria and parking garage. |

Forstone Capital and CapRok Real Estate form Joint Venture to Acquire Premier Westport, CT Retail Location Connecticut Post, Stamford Advocate, Danbury News Times, Greenwich Time |

|

Forstone Capital, in partnership with CapRok Real Estate, today announced its acquisition of 1365-1391 Post Road East, a retail property in Westport, CT consisting of two buildings and nearly 50,000 square feet of space. The property, located along one of Fairfield County’s most heavily trafficked retail corridors, is an easily-accessible shopping destination featuring over 750 feet of frontage, three surface parking lots, and covered garage parking, all in a highly desired neighborhood. 1365-1391 Post Road East is a top-tier retail location with longstanding tenants and considerable further potential. Over 22,000 cars pass by the property every day due to its prime spot along Westport’s Route 1 and short distance from Interstate 95. “The purchase of 1361-1391 Post Road East is significant milestone for our company,” said Brett Wilderman, Principal, Forstone Capital. “It’s a property that exemplifies our ambition in the commercial real estate market and demonstrates our overall investment strategy. We’re looking forward to improving the property and having a positive impact on the Westport community.” The property’s two buildings house popular retail destinations: 1365 Post Road East is occupied by Anthropologie and Parc Monceau, while Balducci’s Market calls 1391 Post Road East home. Both Anthropologie and Balducci’s have been tenants for nearly two decades, serving as enduring commercial cornerstones within Westport’s thriving retail community. “Westport, CT and the broader Fairfield County market have enjoyed strong performance over the past several years,” said Michael Psyllos, Managing Partner at CapRok Real Estate, “and the acquisition of this asset underscores our company’s commitment to identifying well-located real estate investment opportunities, where we, along with our partners, can add value.” Bruce Wettenstein, SIOR, and David Fugitt, SIOR, Partners at Vidal/Wettenstein Commercial Real Estate, served as the sole agents involved in the transaction. Shem Creek Capital of Wellesley, Massachusetts provided third party debt financing. Counsel for the seller was Jamie Gerard of Nevas, Capasse & Gerard of Westport. Counsel for the purchaser was Howard Komisar of Berkowitz, Trager & Trager, also of Westport. “This is an outstanding investment from a business standpoint and an irreplaceable piece of real estate,” said David Fugitt, Partner with Vidal/Wettenstein. |

New funds available for affordable housing Connecticut Post, Stamford Advocate, Danbury News Times, Greenwich Time |

|

HARTFORD -- Ten affordable housing developments worth more than $263 million were among the first recipients of a round of competitive state grants and loans announced Thursday by Gov. Dannel P. Malloy. The multifamily developments, representing 1,018 units -- with at least 367 to be leased at below-market, affordable rates -- include three in Bridgeport and one in Norwalk. Most of the projects are eligible for up to $5 million each in state support. It's part of a 10-year, $500 million effort to foster so-called workforce affordable housing throughout the state that was previously approved by the General Assembly. The state money is designed to bolster private financing for the projects. Malloy made the announcement during a noontime news conference in the Legislative Office Building. "The entire state's investment between 2000 and 2010 was $200 million," Malloy said. "Our administration has made an unprecedented commitment to affordable housing. Affordable housing is integral to stimulating economic develop and growing jobs. We invest in our cities and make them better places to live and work." In Bridgeport, the South End Community Building Initiative will develop nine units worth $1.2 million, and Urban Green will build 87 units in the Jayson/Newfield development, worth $31.5 million, said Bridgeport Mayor Bill Finch. The state is targeting $5 million to the Urban Green project.

Bridgeport Mayor Bill Finch announces that three city affordable housing development projects, including the Mechanics & Farmers bank building, received state grant money, on McLevy Green in downtown Bridgeport on Thursday, August 2, 2012.

Brett Wilderman of Forstone Capital, owner of the Mechanics & Farmers building that is receiving state development dollars, on McLevy Green in downtown Bridgeport on Thursday, August 2, 2012.

Brandon Hall of Forstone Capital, owner of the Mechanics & Farmers building that is receiving state development dollars, on McLevy Green in downtown Bridgeport on Thursday, August 2, 2012. Also, Forstone Capital will obtain about $3.3 million to state support for its $16.2 million project to create 30 units at the former Mechanics and Farmers Bank building on Main Street. Finch, during a news conference Thursday afternoon on McLevy Green, directly across from the Mechanics & Farmers building and within walking distance of the other two projects, said the state money is a crucial piece of their financing. Brandon Hall, of Forstone Capital in Darien, said if the state support had not come through, "We don't know what we would have done, to be honest" in finishing the Mechanics & Farmers conversion. David Kooris, the city's new economic development officer, said the Mechanics & Farmers proposal in particular is crucial to the continued revitalization of Bridgeport. Fletcher-Thompson Inc., an engineering and design firm that was founded in Bridgeport in 1910 and left for Shelton in 2002, will design and oversee construction then lease space in the former bank. "The anchor tenant sends a signal to the world Bridgeport deserves another look," Kooris said. And Kooris said the new housing, 18 units of market-rate and 12 units of affordable housing based on tenant income, is key to bringing more pedestrians downtown to support emerging businesses and entertainment. "These are units occupied by young professionals priced out of Stamford and Norwalk," he said. Elizabeth Torres, executive director of the Bridgeport Neighborhood Trust, said that group's South End Community Building Initiative is key to reclaiming an eight-block area filled with foreclosed upon homes and properties on the brink of foreclosure. "It's part of a larger neighborhood stabilization strategy," Torres said. Finch said he appreciated the effort because he used to live in the South End. In Norwalk, the 34-unit River Commons apartments on School Street will receive funding as part of its overall $10.4 million renovation of the property. Catherine Smith, commissioner of the state Department of Economic and Community Development, told reporters that about $80 million in long-term bonding already has been approved for the housing program. |

Forstone Receives 2011 Regional Economic Impact Award CT Plus |

|

On Wednesday, December 14, 2011, Forstone Capital, LLC was the proud recipient of the Economic Development Regional Impact Award from the Bridgeport Regional Business Council. Forstone Capital was recognized for its outstanding performance in Economic Development, one of the five priorities designated by the Business Council. The award was accepted on behalf of Forstone Capital by Brandon Hall and Brett Wilderman, Principals.

Brandon Hall and Brett Wilderman accepting the 2011 Economic Development Regional Impact Award.

Brandon Hall and Brett Wilderman with other recipients of 2011 Regional Impact Awards including Education, Healthcare, Sustainability and Small Business. Photos: Roger Stall Photography |

Stamford's Harbor Point adds two more restaurants CT Post, Stamford Advocate, Greenwich Time, Danbury News Times |